With respect to credit currency, a couple popular solutions that you could believe was a consumer loan and you will home financing. If you’re these finance serve more aim, its essential to understand their secret distinctions and work out informed financial conclusion. Regardless if you are planning submit an application for a consumer loan or safer a home loan, knowing the distinctions ranging from these two kind of financing might help you choose the best choice for your needs.

Trick Takeaways:

- A personal bank loan is a flexible personal bank loan which can be utilized for various objectives, while a mortgage are a guaranteed financing particularly regularly get a property.

- Signature loans normally have large rates and you may faster terms and conditions, when you are mortgages promote down rates and you will extended terms.

- The new approval techniques private financing can be reduced and requirements a lot fewer prerequisites as compared to mortgages.

- Personal loans provide economic liberty, when you find yourself mortgage loans was tailored for house orders.

- Consider carefully your financial desires and you will particular need whenever deciding ranging from a great unsecured loan and you may a home loan.

Personal loans

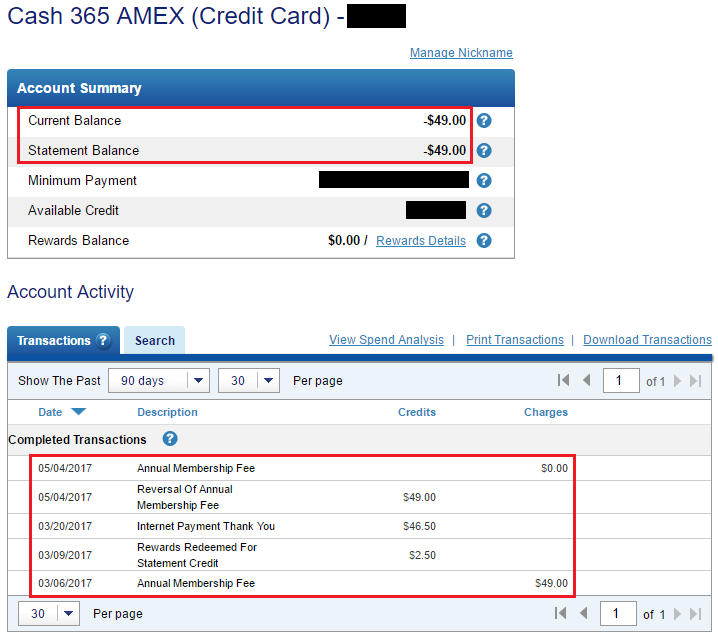

Signature loans is actually a handy and versatile economic service for several objectives. With personal loans, you have access to money without the need for collateral, causing them to personal loans. These money shall be used to own combining debt, layer unanticipated expenses, otherwise and also make a big pick.

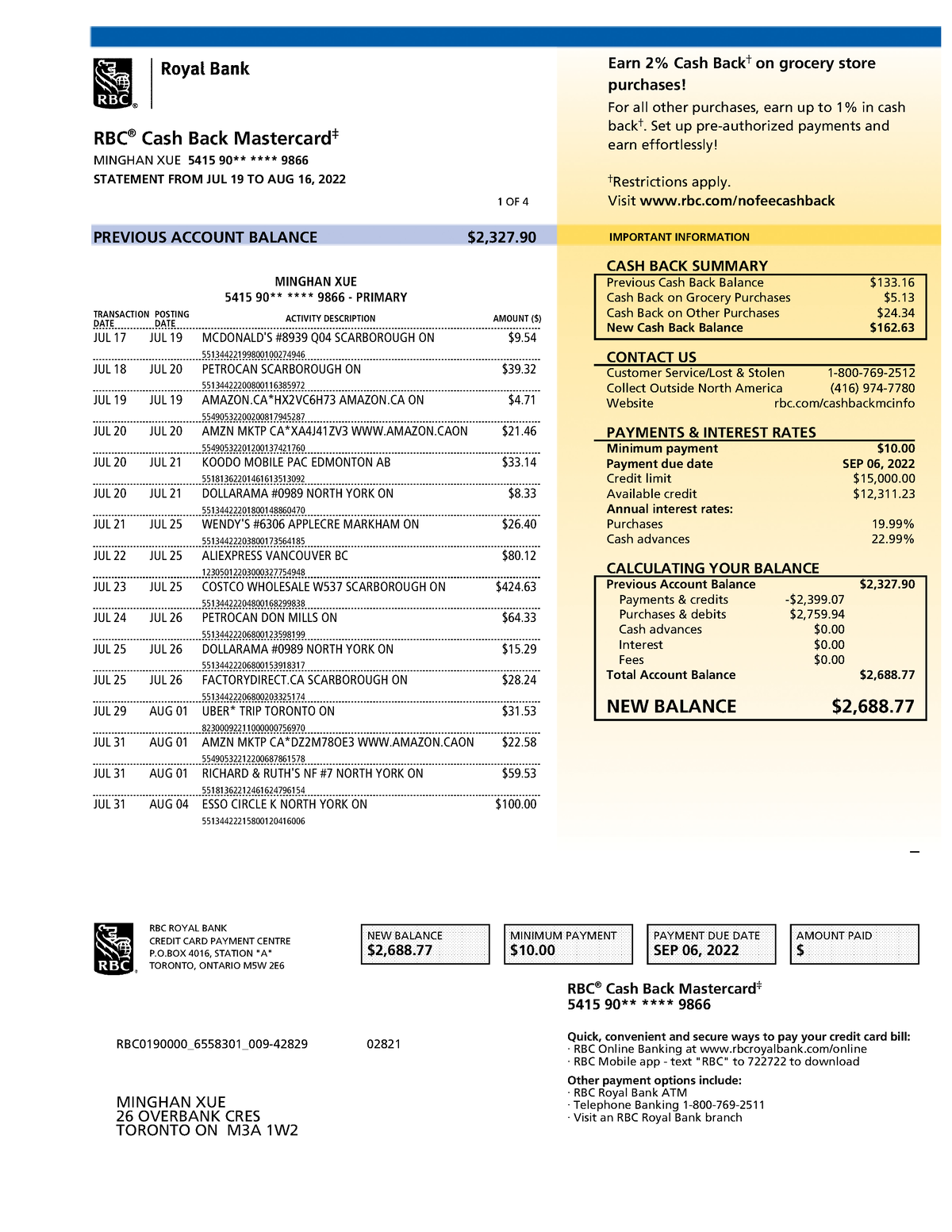

The borrowed funds number and you can term private financing may differ founded for the several factors, such as the lender’s regulations and your creditworthiness. The eye pricing on the unsecured loans may also differ dependent on your credit score. You will need to observe that a far greater credit history tend to translates so you’re able to significantly more positive interest levels.

One of several trick benefits associated with unsecured loans is their freedom. There is the independence to make use of the loan number based on your specific economic needs. Signature loans bring monetary independency, letting you take control of your expenses effortlessly and achieve your goals.

If we would like to consolidate personal debt, finance a large buy, or maybe just involve some economic independency, signature loans are a beneficial option. Reach out to reputable loan providers and you can discuss your options available to your. Be sure to https://cashadvancecompass.com/personal-loans-sd/ evaluate interest rates, mortgage terms and conditions, or other relevant factors to pick the best consumer loan one to aligns along with your monetary needs and needs.

Mortgages

A mortgage is a kind of secured mortgage created specifically having purchasing a property. When you make an application for a home loan, the property youre purchasing functions as collateral into financing. As a result if you’re unable to help make your home loan repayments, the lender gets the right to need fingers of the house as a result of a system known as foreclosure. So, it is crucial to see the conditions and terms of the mortgage before investing in it.

Among the trick factors whenever delivering a mortgage ‘s the deposit. Very mortgages need a deposit, that’s a portion of your own overall price of your property. The quantity of the brand new down-payment can differ depending on the sort of financing along with your certification while the a borrower. And work out a larger down-payment can help you secure ideal mortgage words and lower interest rates.

The mortgage name and you will rates having mortgages believe certain products, together with your financial profile plus the current market criteria. A lengthier mortgage label will provide you with more time to settle the newest financing, but it addittionally function spending more in the interest over the life of mortgage. Interest rates can vary, so it is vital that you evaluate costs off some other loan providers to obtain the best bargain.

Once you pick property which have a home loan, it is important to just remember that , the house in itself serves as guarantee to your financing. Because of this when you find yourself unable to build your home loan costs, the financial institution has got the to foreclose on the assets and sell it to recover the newest outstanding equilibrium. Avoiding property foreclosure are going to be a priority, that you can features significant economic and you may mental consequences.